Hardware/Software Business Models

The simplest and most traditional business model for a hardware product is as follows:

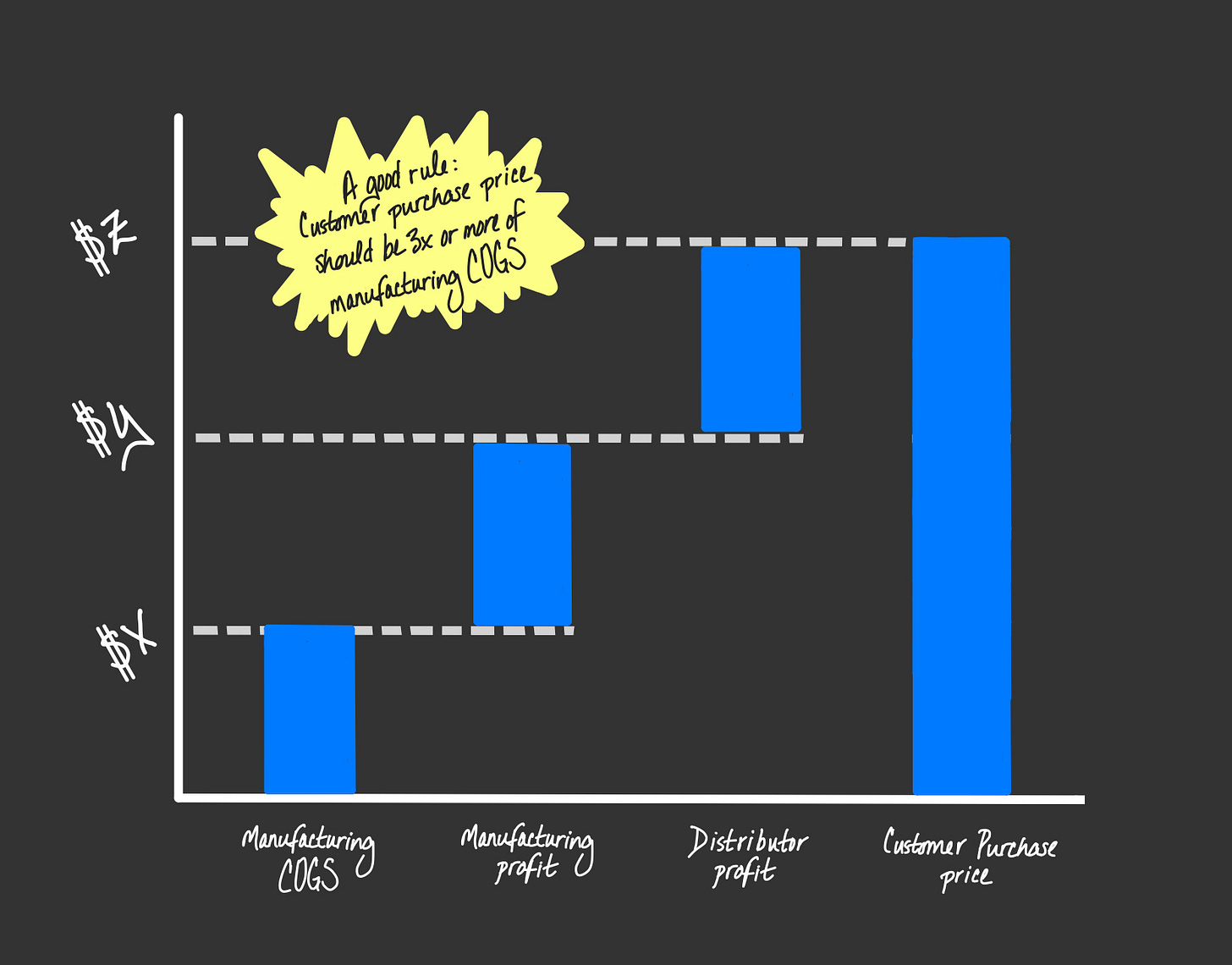

You manufacture/assemble your product for

$Xper unit (including cost of components, labor, overhead, etc.). X is your “Cost of Goods Sold”, or COGS.You sell that product to a distributor/retailer/dealer for

$Yper unit.$Y-$Xis your product margin, which you spend on sales, marketing, and overhead; whatever’s left after you spend that money goes in your pocket as profit.The distributor/retailer/dealer will sell the product to an end consumer for

$Zper unit.$Z-$Yis the distributor’s product margin, which they similarly spend on sales, marketing, and overhead, pocketing whatever’s left over as profit.

If the price that a customer is willing to pay ($Z) is significantly higher than the cost of manufacturing/assembling the product ($X), such that both you and the distributor can run a profitable business off of that margin, you’re good. Expected margins can vary, but a good rule of thumb is that you want the customer selling price to be 3x or more of your COGS. Z>3X is a decent business, and anything less than that is going to be on the struggle bus.

This business model is being disrupted in a thousand different ways in a thousand different industries. Much like web 2.0 tech (AJAX and friends) that made it possible to deliver true software applications via a web browser opened the door to “Software-as-a-Service” (SaaS), IoT and the introduction of web and mobile software into hardware products is opening the door to “Hardware-as-a-Service” (HaaS) businesses, where companies deliver an ongoing service through a hardware product, and charge a subscription rather than selling you the hardware.

But before we get into a discussion of Hardware-as-a-Service, we have to lay the groundwork by talking about all of the various ways that companies monetize hardware products, and what happens to these business models when you start to inject software into the mix.

For the purposes of this discussion, we’re going to use automotive examples — the businesses that operate in and around automotive sales.

Business model #1: Hardware purchase

As described above, the simplest and most common model for purchasing a hardware product is that it is sold to the customer as a one-time purchase. This is the default business model for most hardware products that aren’t terribly expensive.

Within the automotive industry, a good illustrative example here is buying new tires. If I want to buy a new set of tires, I’m probably going to go to Costco and purchase a pair outright. An average set of tires will cost me between $500 and $700 based on the vehicle I own; I’ll throw that on my credit card, and I will own the tires outright. My relationship with the manufacturer lasts for mere seconds, and unless the tires turn out damaged or defective, I hope I never have to interact with the manufacturer again.

Business model advantages: Payment from your customer is all up-front, so this model often has the best cash flow return to the business. This model is also simple and has very clear delineation of ownership, which has some legal advantages.

Business model disadvantages: While your product might create value for your customer for years, you only have one opportunity to capture value — the initial purchase. This business model also disconnects manufacturers from customers; the manufacturer’s goal is not to ensure that you derive value from the product they sell you, but simply to convince you to buy the product in the first place. The result is companies that tend to be better at marketing than they are at product development.

What happens when you add software to the product? Bad things. “Smart”, software-enabled products rely on cloud services that have to be maintained and mobile apps that have to be kept up to date. Companies that provide software-enabled products but have no ability to monetize that software through recurring revenue will eventually go out of business. This is one of the reasons that Consumer IoT companies have struggled, other than Amazon/Google with their deep pockets. To quote a recent article in The Verge about the death of Insteon (a smart home brand): “any small company that relies on a cloud server, doesn’t charge a monthly subscription fee, and lacks deep pockets, is potentially at risk”.

Business model #2: Financed hardware purchase

More expensive products are often financed, where a bank or other financial institution provides a loan to cover the cost of a hardware purchase, which the customer pays off over some period of time. The loan is typically collateralized by the product itself; if you don’t pay your monthly payments, the bank will repossess the product.

Most of us are familiar with financing through car sales. If I want to buy a new vehicle, I can finance my purchase and pay it off over a few years. Outside of consumer products, financing is extremely common; asset-heavy businesses like factories are likely to be full of financed equipment that will be paid off over an extended period of time.

Business model advantages: Like a traditional hardware purchase, the manufacturer gets paid up front; however in this case the customer gets to pay for the product slowly, which they would likely prefer.

Business model disadvantages: Financing carries the same disadvantages of a traditional hardware purchase, along with the added risk of default.

What happens when you add software to the product? From the manufacturer’s perspective, financed hardware purchases aren’t much different from a traditional hardware purchase, so there is still a fundamental economic mismatch when you add software and services to a hardware product. That said, the bank or financial institution that is providing the loan might be interested in information about the state of the product in order to reduce risk of default; that may open the door to a software/services business, with a major caveat that the customer might not want Big Brother spying on them.

Business model #3: Razor/razorblade

Products with a consumable element may be monetized primarily through the consumable and not through the product itself. This is often referred to as a “razor/razorblade” business model, as it was pioneered by Gillette with the invention of the disposable razorblade. Companies with a razor/razorblade model will often sell their product at a loss or even give it away for free in order to sell consumables.

While you probably don’t think of your car as being “consumable”, many of its parts are, ranging from oil and filter replacements to replacement parts that are sold at much higher margins than the car itself. In recent years, dealerships have opted to offer full transparency on the price of your purchase knowing that there will be little to no profit on the sale of the car itself — but they’ll then focus on profiting off of the maintenance and servicing of that vehicle.

Business model advantages: The razor/razorblade model can be extremely lucrative, given that consumables tend to be very profitable, and in many cases companies can give themselves monopoly power over the consumable business by patenting the consumable. Furthermore, the razor/razorblade model aligns the company’s interests with the customer’s interests; you only make money as long as they actually use your product, so you’re likely to work hard to make sure your product gets used.

Business model disadvantages: Razor/razorblade business models can be ticking time bombs – lucrative up until someone figures out how to steal your consumables business away from you. This is particularly painful if you have been selling your product at a loss with the hopes of selling consumables.

What happens when you add software to the product? Any software/services investments you make in your products are likely to be profitable if they increase the rate of consumption of your consumable and/or increase the odds that the customer will buy consumables from you and not from somebody else. “Automated replenishment” is a common software service for razor/razorblade products and is a common reason to start adding software to ensure that consumables are in-stock and identify opportunities to increase consumption.

Business model #4: Rentals

Rentals are common for products that are used only temporarily and where it is reasonable for a company to take back the product after it’s no longer being used, clean and/or refurbish it, and rent it to another customer thereafter.

Car rentals are extremely common while you are on vacation or while your car is in the shop, where you typically rent by the day or week. Another increasingly common variation on the rental model is “pay-per-use”, where rental fees are based on the utility you derive from the product rather than the amount of time that you use it. This model is popular in micromobility (shared e-bikes and e-scooters), where rental periods are often per-minute or per-mile rather than per-day or per-month. Outside of consumer-land, the place where you are most likely to find rented equipment is a construction site, because construction sites are inherently temporary.

Business model advantages: Strong alignment of incentives with the customer, who is only paying for the product while they’re getting value from it. Generates recurring revenue.

Business model disadvantages: While rentals are recurring revenue businesses, rental periods are typically short and therefore churn is high. Rental businesses have high operational costs to clean/maintain/rental equipment. Typically manufacturers don’t do rentals themselves, as the business of making a widget and renting a widget are very different, and rental customers may want or need variety (rental car companies carry many car manufacturers’ products; construction equipment rental companies carry a wide variety of types of equipment).

What happens when you add software to the product? Rental businesses are a great opportunity to add software to a product, if only to reduce operational costs by monitoring the rented equipment, ensuring that it is well cared for, and making sure you can get it back at the end of the rental period. Anything that reduces maintenance cost and/or shrinkage (loss or theft of equipment) is likely to pay dividends back to the rental company and improve their economics.

Business model #5: Hybrid (Purchase + Subscription)

Manufacturers are increasingly selling their products through a hybrid business model where they sell the hardware through the traditional business models described above and then provide additional value-added services that a customer can subscribe to. An automotive example would be purchasing a car through normal means (purchase or financing) while signing up for an additional maintenance contract where you’re going to pay $X/mo that will cover any necessary repairs or maintenance, oil changes, car washes, tire replacements, even car washes.

This model is traditionally used for products that have a heavy maintenance burden associated with their use. Elevators, for instance, may be sold to a building under a hybrid model where the elevator is purchased and owned outright by the building developer/owner, with a long-term maintenance contract where the building owner pays the elevator manufacturer an annual fee to service and maintain the elevator for the lifetime of the building.

Business model advantages: This can be a “best of both worlds” business model, where the hardware sale covers the cost of manufacturing and delivery of the product while the subscription gives the manufacturer an opportunity to create value for (and capture value from) the customer on an ongoing basis.

Business model disadvantages: Customers might be pissed off about needing to pay for a product “twice”; you can only charge a subscription if you are actually creating enough ongoing value to earn it. Companies who add a subscription after the fact to a product that was once sold outright are likely to anger customers, especially if they haven’t earned their keep.

What happens when you add software to the product? Hybrid business models fit well with software-enabled hardware products, as the customer will perceive that they are purchasing the hardware value in the initial sale and the software value through the ongoing subscription.

Business model #6: Hardware-as-a-Service

The most SaaS-like business model for a physical product is a “Hardware-as-a-Service” business model where a customer will pay a subscription that covers both use of the product as well as associated services. There are a lot of variations of this business model ranging from jet engines sold by minute of uptime to long-haul trucking ELDs sold via a monthly fee. These variations are deserving of their own essay, so stay tuned for a deeper dive here in future issues of Atoms & Bits.

In the automotive industry, this is something that car manufacturers have been toying with, although these initiatives are still very experimental and my impression is that subscribing to a car isn’t particularly popular.

Business model advantages: Maximization of Annual Recurring Revenue (ARR). If you want an example of why this is a good business model, check out Samsara’s S-1 and resulting successful IPO. From their S-1: “We focus on maximizing the lifetime value of our customer relationships, and we continue to make significant investments in order to grow our customer base. Due to our subscription model, we recognize subscription revenue ratably over the term of the subscription period.” This focus on long term relationships - and the resulting long term view on revenue - allows Samsara to focus on continuing creating value for their customers. This aligns incentives and orients them toward products that create customer loyalty and encourage lock-in.

Although Samsara’s stock price has dropped since their IPO in December 2021, that drop is strongly correlated with other tech companies’ stock prices dropping, and they’re still worth close to $7Bn, so I think we can call that a win.

Business model disadvantages: Not charging for a product up-front creates a cash flow mismatch, where the manufacturer has paid for manufacturing and assembly but won’t get paid back on that cost for some period of time. In the current interest rate environment, you can probably find a bank or financial institution to cover this gap, but that’s only feasible when interest rates are low and cash is cheap. Also, as described in more detail below, if you’re going to charge a subscription for your product, you have to earn it.

What happens when you add software to the product? I would argue that this business model is impossible unless the product you provide to your customers is software-enabled; software and “as-a-Service” business models go hand-in-hand.

What is the right business model for you and your product?

With all of that groundwork laid, what is a product company to do? If I make and sell physical products, how should I monetize those widgets? If I’m a hardware/software company, how does that change things?

There is no “right” answer, as different product categories and industries have different customer expectations and constraints. However, there are some basic ground rules that I think everyone can follow.

Those ground rules are:

Recurring revenue is more valuable than one-time revenue. The ever-increasing valuations of SaaS businesses over the last twenty years prove that both public markets and private investors value recurring revenue at a premium, because recurring revenue businesses tend to grow faster and become more profitable than businesses driven by one-time purchases.

But — you have to earn recurring revenue, especially subscriptions. Sixt+ will let me subscribe to a car; subscription fees start around $750/mo. That’s a lot of money for a Toyota Camry, which I could probably lease for half of that. Sixt has not earned the right to charge these subscription fees, as they are not providing enough value to a customer on an ongoing basis to justify the premium. As a result I expect the Sixt+ program to either change dramatically or disappear.

Hybrid business models are often a good compromise and a good transition to an “as-a-Service” business model. Going from a traditional hardware sale to a full subscription business model is a heavy lift; hybrid business models can create a lot of flexibility for businesses to create additional value over time through software and ongoing services, and as that part of their offering strengthens, shift from purchase-heavy revenue to subscription-heavy revenue.

Traditional hardware purchases do not support software investments. Companies who are investing money to create ongoing value for customers through software but aren’t charging customers for that value either need infinite cash to support those investments (Amazon/Google) or those products will get shut down (Insteon, Revolv, etc.)

Correct me if I am wrong. It would appear that Particle adheres to the hybrid model. I would be interested to hear about the challenges Particle has faced with this model.

Well said Zach! It would also help if you include financial comparison (ARR/ROI/... etc) between the different models.